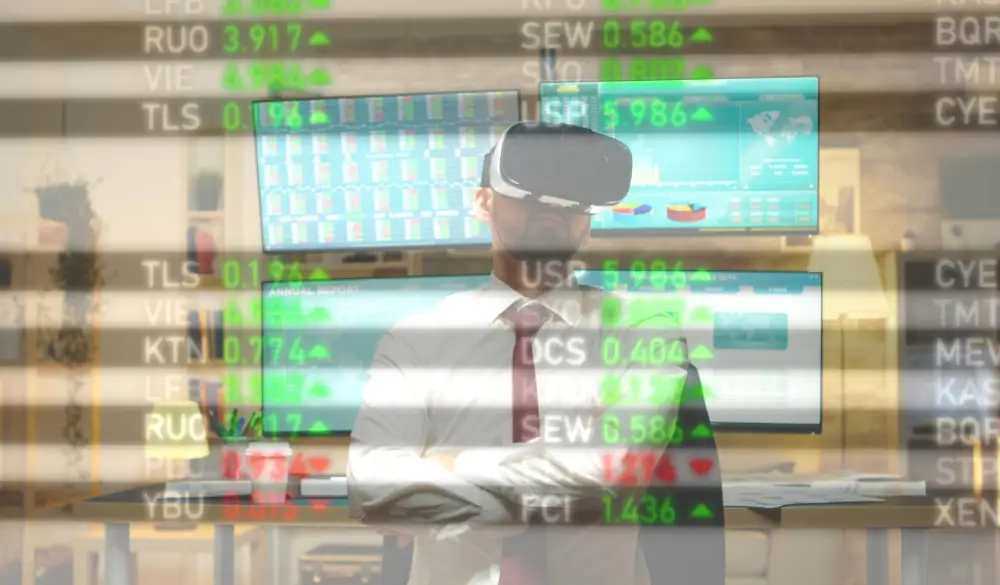

Yesterday’s market developments paint a compelling picture of an evolving financial landscape where traditional economic indicators intersect with the rapidly...

“At Derma Drips, we combine data, strategy and execution to help investors navigate complex markets with voice, self-discipline and an unwavering focus on adjusted performance.”

We specialize in data-driven strategies in the areas of gold futures, cryptocurrencies, forex and fund valuation. Our approach blends precise technology, in-depth fundamental research and automated systems to identify market opportunities and manage risk. From advanced arbitrage models to on-chain analytics and portfolio optimization, we focus on building high-performance trading and investment frameworks. Our team brings together expertise in quantitative finance, economic analysis and algorithmic trading to help clients navigate complex global markets.

We specialize in four key areas at the intersection of data, strategy and execution. Each business line is built on in-depth research, advanced modeling, and a clear goal: to help our clients navigate and succeed in complex financial markets.

We deliver gold futures insights through technical analysis, macro research, risk strategies, and arbitrage models to help investors capitalize on precious metals market movements.

Our crypto strategies use data-driven portfolio models, high-frequency trading, DeFi yield analysis, and on-chain insights to maximize performance in volatile digital asset markets.

We provide forex research focused on technical indicators, central bank policy, carry trade strategies, and risk-parity modeling to support informed currency trading decisions.

We assess fund products through return attribution, manager style analysis, portfolio optimization, and fee impact evaluation to guide smarter investment choices.

Apply sophisticated quantitative modeling techniques to conduct a detailed examination of gold price movements. Focus on identifying key technical indicators, such as support and resistance levels, using historical and real-time data inputs.

Conduct comprehensive investigations into global macroeconomic trends and geopolitical developments. Assess their direct and indirect influences on the pricing and volatility of gold and related precious metals markets.

Design methodical strategies for managing position size and exposure. Use a scientific approach to set profit-taking thresholds and stop-loss limits, ensuring consistent risk-reward optimization.

Engineer arbitrage opportunities that exist between gold and various other precious metals. Focus on uncovering pricing inefficiencies across commodities to create cross-market trading advantages.

Construct diversified digital asset portfolios by applying modern portfolio theory principles. Aim to achieve a balance between maximizing returns and minimizing risk across different cryptocurrency holdings.

Build and fine-tune fully automated trading algorithms. These are specifically designed to operate efficiently in the fast-moving and volatile landscape of cryptocurrency markets.

Evaluate yield generation possibilities across various decentralized finance protocols. Assess and model the risks associated with these yield strategies to improve capital allocation decisions.

Extract actionable insights from blockchain data. Use this data to understand real-time market sentiment, track transaction flows, and monitor capital movements within the digital asset space.

Leverage a wide range of quantitative indicators to analyze the price dynamics of major currency pairs. Use these insights to uncover viable trading opportunities within global forex markets.

Conduct thorough research on central bank decisions and monetary policies. Evaluate how these policies influence currency valuations and broader exchange rate trends across economies.

Formulate currency trading strategies that capitalize on interest rate differentials between countries. Build carry trade portfolios aimed at generating returns with carefully managed levels of exposure.

Develop foreign exchange investment models based on risk parity principles. Focus on achieving balance in portfolio risk allocation by adjusting exposure across multiple currency assets.

Break down fund returns to understand what drives performance. Use quantitative techniques to attribute returns to specific factors such as market movements, asset selection, and timing.

Apply data analysis methods to uncover the underlying investment styles and behaviors of fund managers. Classify managers based on recurring patterns and tactical choices over time.

Design fund investment portfolios that aim to achieve low correlation among holdings. Emphasize portfolios with a high Sharpe ratio, focusing on risk-adjusted performance improvement.

Analyze the long-term impact of fund fees on investment returns. Study how expense ratios and performance-based fees affect the compounding of gains over extended time horizons.

"Working with their team gave us a real edge in commodities trading. The depth of their gold futures analysis was unlike anything we’ve seen. We were able to make faster, more confident decisions thanks to their models."

"Their quantitative crypto strategies have been instrumental in reshaping how we allocate capital. What stood out was their ability to simplify complex data into clear, actionable insights. They’ve become part of our long-term planning."

At the heart of everything we do is a commitment to clarity, precision and efficiency. In an ever-changing marketplace, reliable insight is critical. That’s exactly what we strive to deliver every day. Whether you’re investing in gold futures, cryptocurrencies, forex or fund strategies, our role is to help you move forward with confidence.

Thank you for trusting us and letting us help you achieve your goals.

Founder, Executive Chairman and CEO of Derma Drips

We provide you with insights, strategies and research from the financial frontiers and share them with you to keep you up to date and ahead of the curve.

Yesterday’s market developments paint a compelling picture of an evolving financial landscape where traditional economic indicators intersect with the rapidly...

The ADP employment report showing 104,000 jobs added in July provides a measured foundation for market sentiment. This figure suggests...

Trump’s reaffirmation of the August 1st deadline—presumably related to significant policy implementation—adds a layer of certainty to market planning. Clear...